A Fiduciary:

The term “fiduciary” is commonly defined as “one who holds a fiduciary relation or acts in a fiduciary capacity.”

That definition is a bit shallow and short in substance.

For a term that is important as “fiduciary”, and has existed since the 1600’s, the term has certainly done a good job of concealing its meaning.

A more accurate and descriptive definition would be: “someone to whom property or power is entrusted for the benefit of another.” This definition brings a more profound understanding to the term fiduciary, and what a fiduciary is responsible for.

The most reputable Financial Advisors, Financial Analysts, Bookkeepers, Accountants, Paralegals, and Lawyers are fiduciaries. They’re professionals empowered to act in your interest while managing your assets, your money, or your legal responsibilities. In other words, rather than making recommendations in their own self-interest (i.e.) by pushing services or products that earn higher commissions, etc., a fiduciary advisor is obligated to make recommendations that benefit you.

For example, if a certified bookkeeper is recording and managing your business’s financial transactions and evaluating its financial statements, they are obligated to inform you of any financial concerns they have about your business as well as ways to improve its financial position.

The advantages of working with a fiduciary are numerous. A statistical study uncovered that American adults who work with a fiduciary advisor reported “substantially greater financial security, confidence, and clarity than those who go it alone.”

Given such a clear advantage, shouldn't all business owners and managers be working with a fiduciary advisor? It would certainly be to their advantage. But not just any fiduciary will do. You want to select one that has been fully vetted and has a background of integrity.

Finding a reputable fiduciary that has proven to act in their clients best interests is not always an easy task. For example, using an internet search engine, such as Google is not very helpful, yielding limited results.

Our firm feels that selecting a fiduciary shouldn't require this much work. And now, it doesn't.

All AAFS Team Members that have access to a company’s assets, its bank accounts, credit card accounts or trade secrets act as a fiduciary and work under the umbrella of a Fidelity/Surety Bond. These bonds help to insure fiduciary responsibility, and to protect the assets, financial information, and trade secrets of our clients.

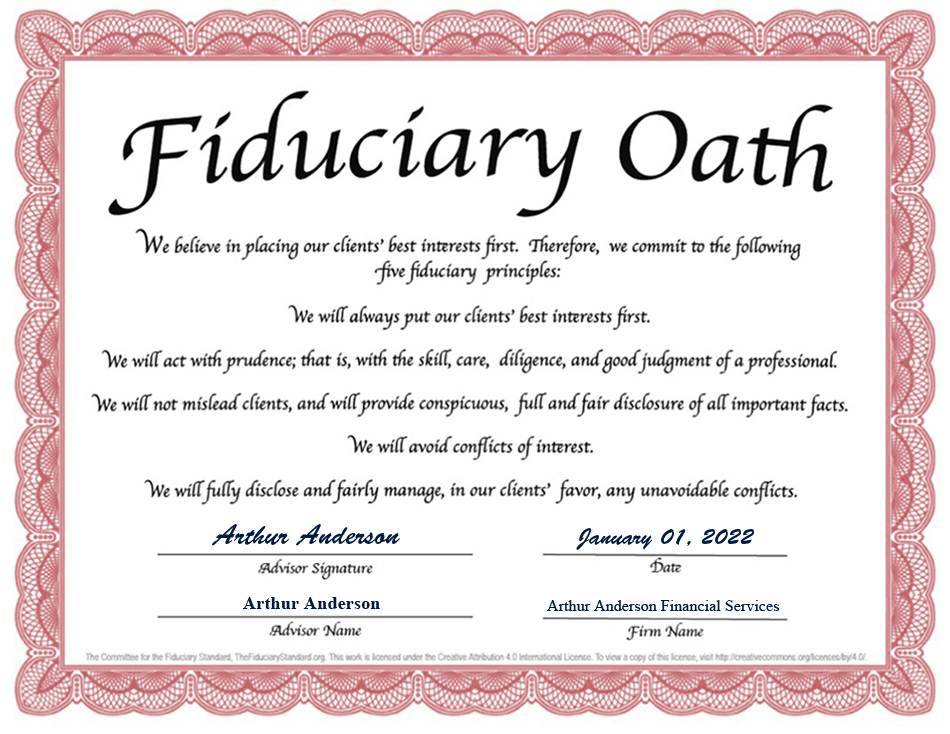

The Fiduciary Oath:

What is a Fidelity/Surety Bond:

Each year businesses lose millions of dollars to staffing personnel theft, with some cases resulting in bankruptcy. Every business that staffs personnel, regardless of size or industry should purchase a Purchase Fidelity Bond fidelity bond to protect it from fraud.

According to recent statistics, staffing personnel dishonesty, which include employees, independent contractors, temporary workers, associates, and affiliate partners are responsible for losses incurred by American businesses of over $50 billion annually.

Under the coverage of a fidelity bond, a business can file a claim against the bond to recover a financial loss due to theft, fraud, or embezzlement. Therefore, when working with a fiduciary, it’s always wise to check and see if they are insured under a fidelity bond.